jefferson parish property tax rate

We collect approximately 790 million dollars per year from over 300 thousand tax payers for 20 different taxing jurisdictions. The Louisiana state sales tax rate is currently.

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

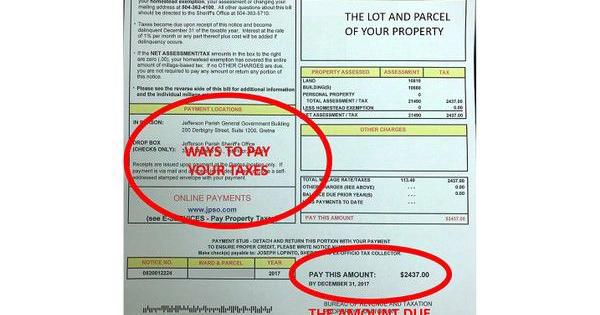

Property taxes are due upon receipt and late after December 31st.

. Property taxes are levied by what is known as a millage rate. This rate is based on a median home value of 180500 and a median annual tax payment of 940. If not property taxes may be.

Jefferson parish collects on average 043 of a propertys assessed fair market value as property tax. The Jefferson Parish sales tax rate is. The Jefferson Parish Assessors Office determines the taxable assessment of property.

Sales Taxes The City levies a 475 sales tax that is collected through the Jefferson Parish Sheriffs Office. The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is. Jefferson Parish Assessors Office.

The 2018 United States Supreme Court decision in South Dakota v. 2016 Jefferson Parish Assessors Office. This is the total of state and parish sales tax rates.

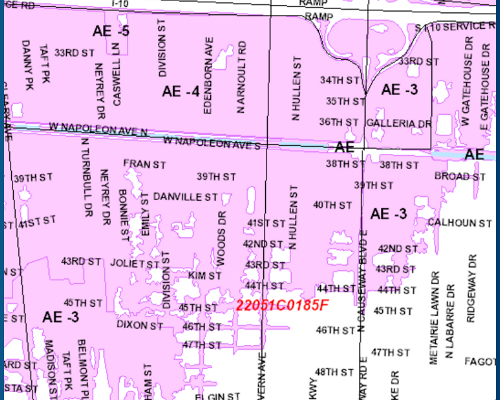

Whether you are presently living here only contemplating taking up residence in Jefferson Parish or planning on investing in its property find out how municipal property taxes work. Millages Wards. Jefferson Parish Property Records are real estate documents that contain information related to real property in Jefferson Parish Louisiana.

The Louisiana Constitution requires residential properties and land to be assessed at 10 of their fair market value by which the tax millage rate is applied. The Jefferson Parish Sales Tax is collected by the merchant on all qualifying sales made within Jefferson Parish. Jefferson Parish Health Unit - Marrero LDH Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes View Pay Water Bill BAA Fine Business Development.

With this guide you can learn useful information about Jefferson Parish property taxes and get a better understanding of what to anticipate when you have to pay. To find an estimate of your yearly taxes you start by multiplying the current Market Value by 10. The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county sales tax.

The Audit Section is. However it ranks low 47 th state-wide out of 71 schools in performance and many believe low teacher pay has been a primary reason for that. The median property tax on a 17510000 house is 31518 in Louisiana.

WVUE - A couple of days ago Jefferson Parish resident Veeda Payne examined her property bill and saw. If you are seeking certification of taxes paid for the purposes of an act of sale re-financing or to comply with other legal requirements please click the Tax Research Certificate button below to order one online or contact the Bureau of Revenue and Taxation 504 363-5710 for a tax research certificate. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

1 Orleans Parish. The Jefferson County Sheriffs Office is the primary property tax collector for state metro Louisville district school fire and other special district taxes. Estimate your Louisiana Property Taxes.

Jefferson Parish residents receiving sticker shock at property tax bills. If the parcel does not have a HEX then the. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar.

Louisiana state allows a deduction up to 75000 for most homeowners. This gives you the assessment on the parcel. The median property tax on a 17510000 house is 75293 in Jefferson Parish.

You have chosen. The calculator will automatically apply local tax rates when known or give you the ability to enter your own rate. Audits are assigned at random upon review of taxpayer returns and upon information received from other taxing jurisdictions local state and federal.

The following local sales tax rates apply in jefferson parish. Located in southeast Louisiana adjacent to the city of New Orleans Jefferson Parish has a property tax rate of 052. The median property tax also known as real estate tax in Jefferson Parish is 75500 per year based on a median home value of 17510000 and a median effective property tax rate of 043 of property value.

Free jefferson parish property records search. When contacting jefferson parish about your property taxes make sure that you are contacting the correct office. Use this Louisiana property tax calculator to estimate your annual property tax payment.

Other New Orleans-area parishes. Tax on a 200000 home. If your homesteadmortgage company usually pays your property taxes please forward the tax notice to them for payment.

Jefferson Parish schools are the largest public school system in Louisiana with nearly 50000 students. You must submit your change of address in writing to the address below. John the Baptist Parish.

Tax on a 200000 home. Tax on a 200000 home. The median property tax on a 17510000 house is 183855 in the United States.

If a Homestead Exemption HEX is in place you would then subtract 7500 75000 HEX x 10 from the assessed value to get the taxable amount. The Jefferson Parish Audit Section focuses on ensuring taxpayer compliance with local tax ordinances and the discovery of unreported or underreported tax revenues. One mill is one-tenth of one percent or 001.

Bgr Analyzes Jefferson Parish Sheriff S Office Tax On The April 30 Ballot Biz New Orleans

Jefferson Parish Sheriff Joseph Lopinto Will Seek Property Tax Increase For Employee Pay Raises Crime Police Nola Com

Home Page Morehouse Parish Assessor S Office

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans

Jefferson Parish Property Owners Will Pay More Taxes Soon Here S Why Local Politics Nola Com

Home Ownership Matters Jefferson Parish Voters Agree To Raise Property Taxes To Increase Teacher Wages Improve Schools

Jefferson Parish Residents Will See Several Millages On Ballot